EDUCATIVE | BAKI

Turning devaluing currencies into profits

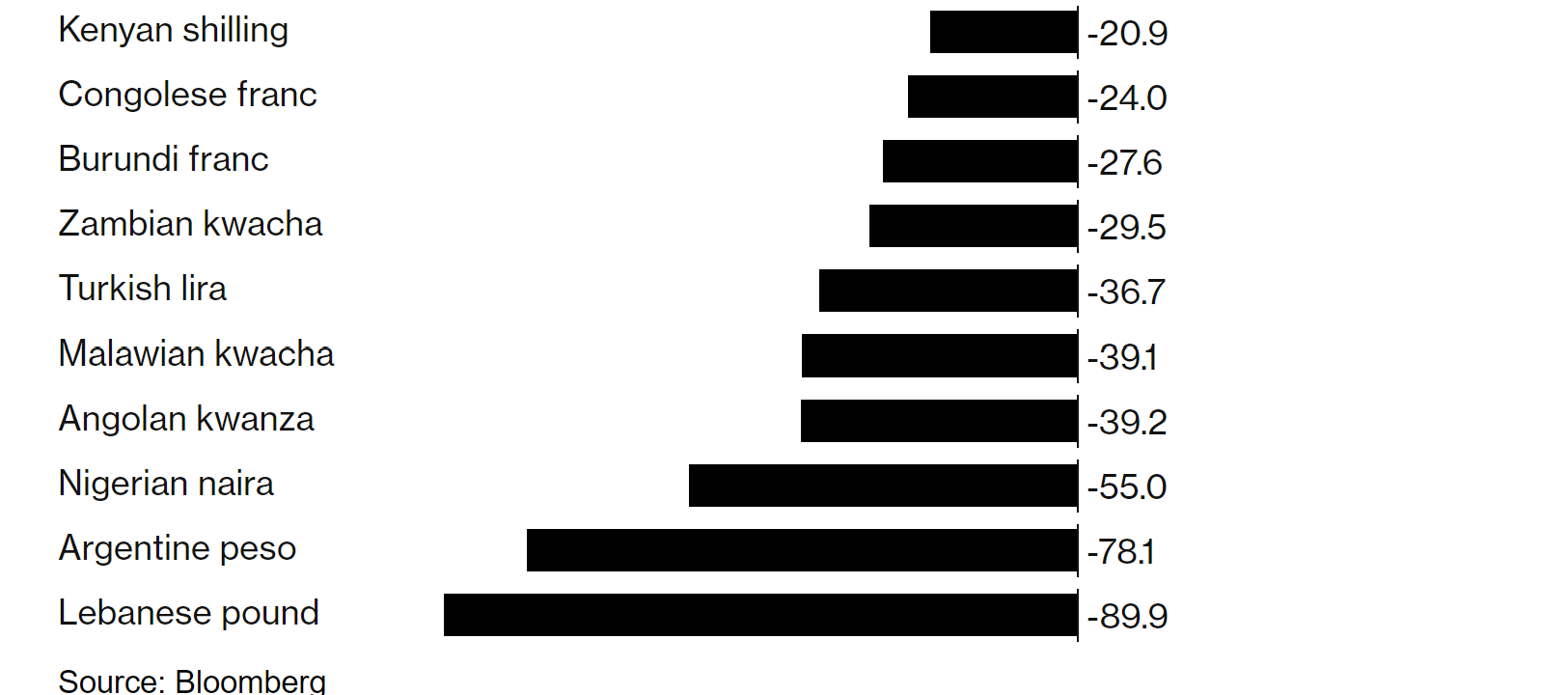

Emerging markets are notably plagued by currency volatility. Nigeria’s

naira, for example, has claimed both the

best

and

worst

performer titles against the dollar—in 2024 alone. For many individuals and

businesses, especially those seeking to export profits, the swipes in the

value of local currencies often result in significant losses. Not seeing a

way out of this, several multinationals are fleeing Africa. Now, imagine a

world where these devaluing currencies could turn into profits for

stakeholders. That’s what Canza Finance is doing through BAKI.

Baki

is an exchange that allows users to short local currencies against

stablecoins pegged to the U.S. dollar. The concept is simple yet ingenious.

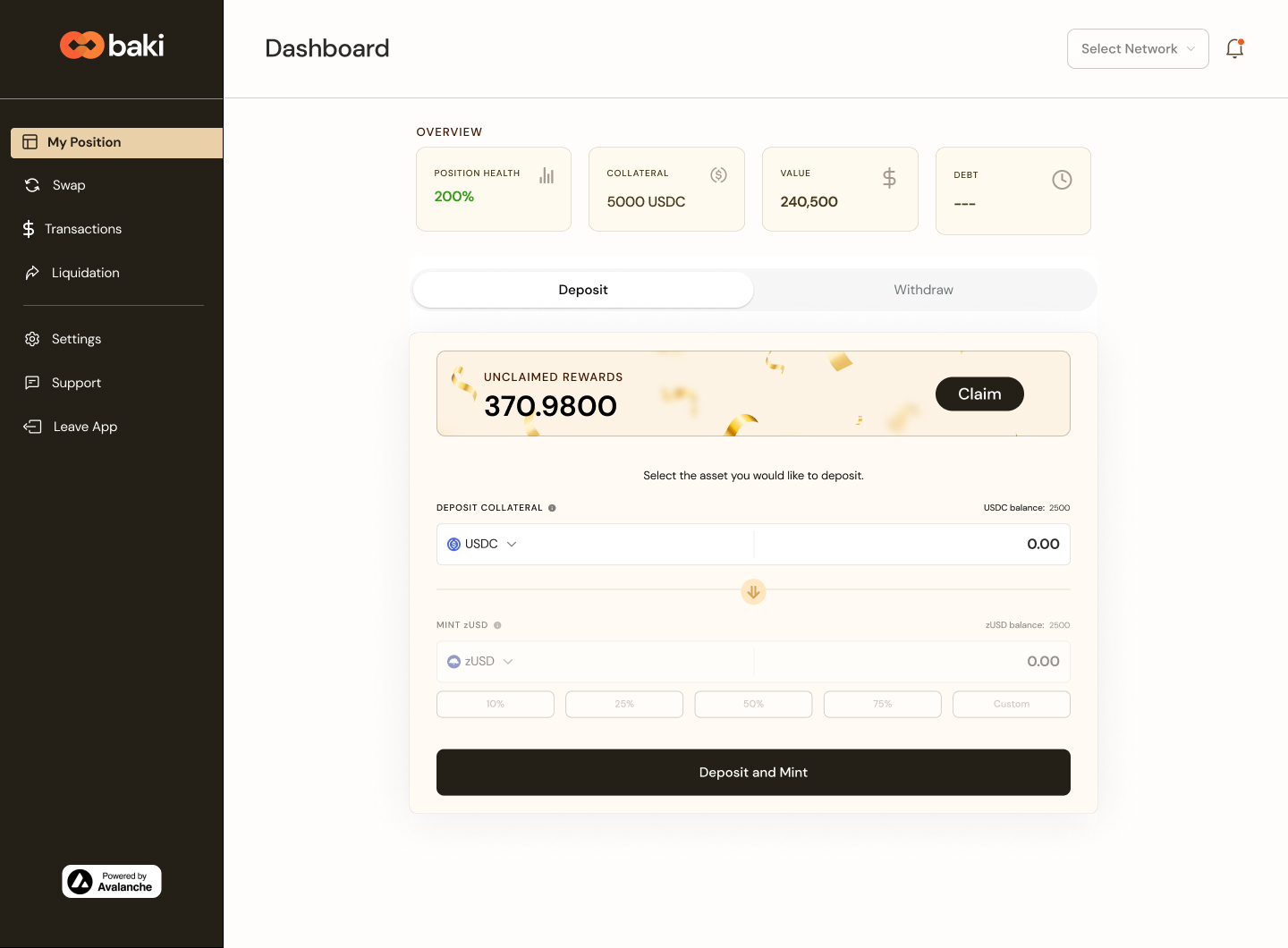

Traders deposit US dollar-pegged stablecoins like USDC as collateral on

Baki. They then mint zUSD, Baki's native stablecoin, and use it to borrow

tokenized versions of local currencies like the Nigerian naira (zNGN) at

prevailing bank exchange rates.

If the local currency devalues against the dollar, as often happens in

emerging markets, the value of the borrowed tokens decreases in dollar

terms. However, the trader still holds the same amount of the local currency

tokens they originally borrowed. This allows them to repay their loan using

fewer zUSD than they initially borrowed, pocketing the difference as profit.

A step-by-step guide to using the Baki platform:

"Baki's cashback system might just be the best way to leverage currency

devaluation," boasts Oyedeji Oluwoye, co-founder and CTO of Canza Finance.

The cashback mechanism is a key selling point, catering to the ever-growing

community of "Degens" - decentralized finance enthusiasts seeking innovative

ways to generate yields. By providing an implicit short on local currencies,

Baki offers a unique value proposition that appeals to traders looking to

capitalize on emerging market volatility.

Unlike traditional forex trading, Baki operates on decentralized blockchain

rails, providing users with greater transparency, self-custody of funds, and

the ability to bypass bureaucratic hurdles common in mainstream finance.

"For businesses in Africa, foreign exchange transactions can be a slow,

tedious, and expensive process," explains Oluwole. "Baki allows them to

perform slippage-free swaps at official central bank rates, retaining value

and reducing transaction costs."

While BAKI currently supports major African currencies like the naira and

CFA franc, Canza Finance plans to expand to other emerging markets in due

time.

"Baki's cashback system might just be the best way to leverage currency

devaluation," boasts Oyedeji Oluwoye, co-founder and CTO of Canza Finance.

As decentralized finance continues to disrupt traditional finance, platforms

like Baki demonstrate the immense potential of blockchain technology to

unlock new investment opportunities and profit avenues. There’s no

substantial indication that the trend of devaluing currencies will shift

anytime soon, so converting it to yield remains a huge value proposition for

the blockchain platform.

Nodo.xyz

NODO is a pan-African builder & user community platform powered by Web3 SocialFi.

Share